Muscat— Today in Muscat, the Ministry of Endowments and Religious Affairs hosted the inaugural gathering of endowment institutions in Oman, focusing on the difficulties endowment institutions face and the standards for compliance.

The meeting welcomed Ahmed Saleh Al Rashdi, the Undersecretary of the Ministry of Endowments and Religious Affairs.

Al Rashdi expressed that this first gathering serves as an essential venue uniting all public and private endowment institutions. In comments to the Oman News Agency, he emphasized that the event, which included 35 institutions, centered on discussing obstacles and potential solutions for endowment bodies, in addition to strategies for implementation.

He underscored the ministry’s initiation of the Endowment Institutions Readiness Assessment initiative, designed to evaluate institutions on various aspects including governance, regulation, compliance, board structuring, executive management, and investment practices. These criteria vary in importance concerning the overall assessment of readiness.

Al Rashdi pointed out that the average level of readiness among endowment institutions indicates their level of maturity, noting that Oman has a storied endowment history of over a millennium that remains vibrant today. He clarified that contemporary endowment institutions function with professionalism, featuring organized boards, executive management teams, educational committees, as well as legal, risk, and investment departments.

Although the management of endowments in Oman is relatively recent, Al Rashdi recognized notable advancements, attributing this progress to the critical functions these institutions fulfill in society, especially in health and education. The ministry's objective is to bolster public confidence in endowment institutions, which currently number over 70, encompassing important entities.

The ministry serves as a regulator and legislative body, having put in place governance structures for both public and private endowment institutions alongside a governance consultancy. It has also mandated that external auditors assess these entities.

Hilal Hamad Al Sarmi, Executive Director of the Athar Health Endowment Institution, remarked on the significance of this initial meeting, emphasizing its role in showcasing the achievements and functions of endowment institutions. He mentioned to the Oman News Agency that while these entities are still in their early stages in Oman, governance-driven operations necessitate time for complete evolution. He added that regular meetings would raise awareness of their initiatives and encourage collaboration among stakeholders.

Al Sarmi identified financial limitations, insufficient key supporters, and challenges in launching endowment investments as major obstacles. He advocated for joint investment endeavors between institutions and the ministry, particularly in the realm of financial digitalization.

He pointed out that Athar is dedicated to enhancing healthcare, collaborating with medical establishments, and seeking funding from donors for crucial medical supplies and equipment.

On a related note, Eng. Mohammed Salim Al Busaidi, a Board Member of the Bousher Endowment Institution, characterized the meeting as a crucial step in bringing together stakeholders. He conveyed to the Oman News Agency that institutional endowments are still relatively "new" in Oman, with governance policies, boards, and executive councils established under the guidance of the ministry. He noted that the forum enabled discussion of challenges and the sharing of expertise.

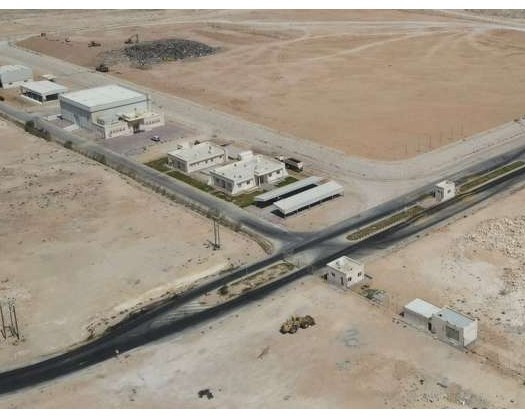

Al Busaidi emphasized the ministry's role in creating investment prospects through endowment assets, highlighting that there are more than 39,000 endowment assets in Oman, many of which are in need of investment. He called on the ministry to facilitate opportunities for institutions to leverage these financial resources.

Dr. Badr Khalfan Al Rashdi of the Sumail Public Endowment Institution remarked that the purpose of the meeting was to confront the difficulties encountered by both public and private endowment organizations, while also highlighting their experiences. He pointed out the strong tradition of endowments in Oman; however, he highlighted the necessity for modernized institutional operations. Al Rashdi identified governance, revenue generation, investment strategies, and partnerships as significant obstacles. Furthermore, he mentioned that newer organizations struggle with generating income, effective marketing, investment know-how, and developing their workforce.

At the event, Dr. Mohammed Fakhri Suwailah from Bank Nizwa delivered a presentation entitled Accounting Standards for the Endowment Sector, which encompassed aspects of financial accounting, auditing, and ethical practices within the profession. He detailed essential accounting concepts such as monetary units, historical cost, revenue recognition principles, materiality, comprehensive disclosure, the accrual method, and maintaining consistency. He indicated that endowment assets are categorized into those that can be utilized immediately and those that are intangible.

The meeting highlighted the increasing institutionalization within Oman’s endowment landscape, addressing various financial, operational, and governance issues aimed at improving the sector's societal contributions.